Tax-advantaged retirement accounts such as 401(k) plans and IRAs are intended to promote long-term retirement savings and thus offer preferential tax treatment in return for a commitment to keep savings in the account until at least age 59½. Withdrawals before that age may be subject to a 10% federal income tax penalty on top of ordinary income tax. However, there is a long list of exceptions to this penalty, including several new ones added by the SECURE 2.0 Act of 2022.

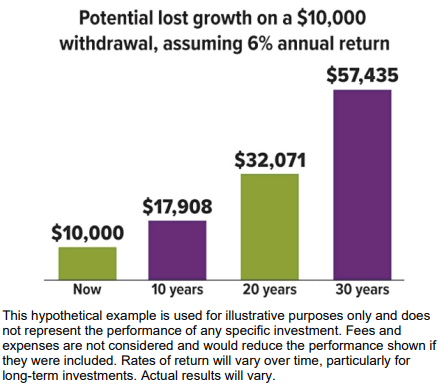

Before considering these exceptions, keep in mind that the greatest penalty for early withdrawal from retirement savings could be the loss of future earnings on those savings (see chart). Even so, there are times when tapping retirement savings might be necessary.

Some employer plans allow loans that may be a better solution than an early withdrawal. If a loan or other resources are not available, these exceptions could help. They apply to both employer-sponsored plans and IRAs unless otherwise indicated.

New Exceptions

The SECURE 2.0 Act added the following exceptions to the 10% early withdrawal penalty. Withdrawals covered by these exceptions can be repaid within three years. If the repayment is made after the year of the distribution, an amended return would have to be filed to obtain a refund of any taxes paid.

- Disaster relief — up to $22,000 for expenses related to a federally declared disaster; distributions can be included in gross income equally over three years (effective for disasters on or after January 26, 2021)

- Terminal illness — defined as a condition that will cause death within seven years as certified by a physician (effective 2023)

- Emergency expenses — one distribution of up to $1,000 per calendar year for personal or family emergency expenses; no further emergency distributions allowed during three-year repayment period unless funds are repaid or new contributions are at least equal to the withdrawal (effective 2024)

- Domestic abuse — the lesser of $10,000 (indexed for inflation) or 50% of the account value for an account holder who certifies that he or she has been the victim of domestic abuse during the preceding one-year period (effective 2024)

Exceptions Already in Place

These exceptions to the 10% early withdrawal penalty were in effect prior to the SECURE 2.0 Act. They cannot be repaid unless indicated.

- Death or permanent disability of the account owner

- A series of substantially equal periodic payments for the life of the account holder or the joint lives of the account holder and designated beneficiary

- Unreimbursed medical expenses that exceed 7.5% of adjusted gross income

- Up to $5,000 for expenses related to the birth or adoption of a child; can be repaid within three years

- Distributions taken by an account holder on active military reserve duty; can be repaid up to two years after end of active duty

- Distributions due to an IRS levy on the account

- (IRA only) Up to $10,000 lifetime for a first-time homebuyer to buy, build, or improve a home

- (IRA only) Health insurance premiums if unemployed

- (IRA only) Qualified higher education expenses

Lost Opportunity

An early retirement plan withdrawal could end up costing more than you might imagine, even without the 10% penalty. Income taxes will reduce the present value of the withdrawal, and you will lose the potential long-term growth on the amount withdrawn.

Special Exceptions for Employer Accounts

The 10% penalty does not apply for distributions from an employer plan to an employee who leaves a job after age 55, or age 50 for qualified public safety employees. SECURE 2.0 extended the exception to public safety officers with at least 25 years of service with the employer sponsoring the plan, regardless of age, as well as to state and local corrections officers and private-sector firefighters.

Retirement account withdrawals can have complex tax consequences. Consult your tax professional before taking specific action.